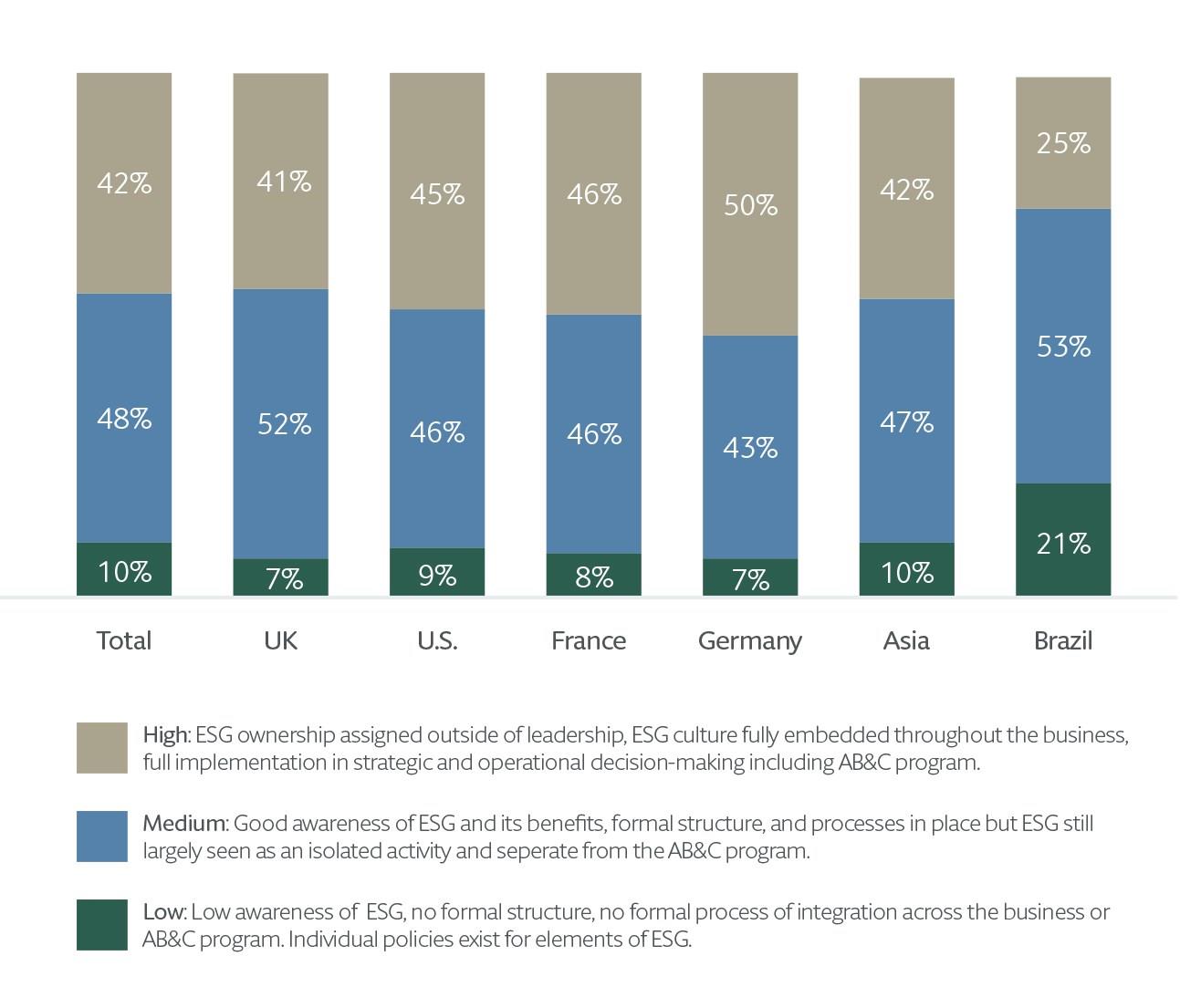

What is the level of maturity of the ESG program or policies within your organization?

U.S. spotlight

By Stephanie Yonekura Partner, Los Angeles and Shelita Stewart Partner, Washington, D.C.

Organizations in the U.S. are more likely than any other market to underestimate ESG vulnerabilities in their third-party relationships, with over a third (34%) of compliance leaders deeming them ‘hardly any risk at all’ to their business. Compliance leaders in the U.S. are also forecasting the level of ESG risk to increase later than compliance leaders in other markets, which may indicate that they are less focused on or prepared for the current risks that those third-party relationships can present.

This trend may be attributable to the relative infancy of ESG legislation in the U.S. as compared to jurisdictions across the pond in Europe. Varying federal, state, and local regulatory requirements can be challenging to track and prioritize. But that may be changing, as the U.S. Securities and Exchange Commission (SEC) has turned its attention to ESG by announcing the formation of a Climate and ESG Task Force in March 2021 and proposing specific ESG disclosure requirements in May 2022. The SEC has been active in investigating companies’ climate change impact and has recently expanded its focus to the social governance space as well. As more companies come under the regulatory spotlight, it is likely that their sector peers will take notice.

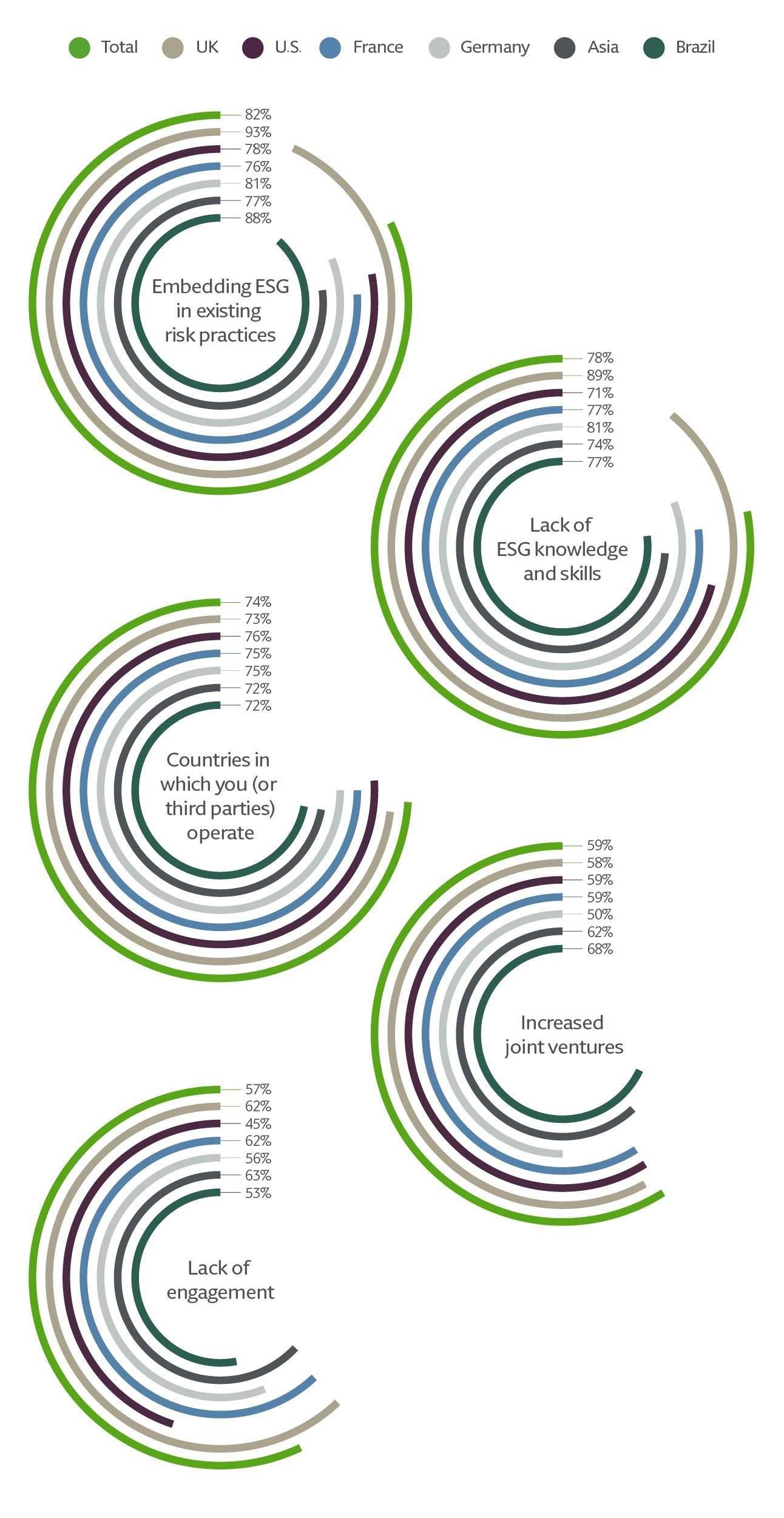

Our data shows that this is already starting to happen; 88% of compliance leaders in the U.S. believe that ESG is becoming a priority for their organization and, in comparison with other regions, compliance leaders in the U.S. are the least likely to see their ESG risk management as being impeded due to a lack of engagement (45%).

UK spotlight

By Liam Naidoo Partner, London and Crispin Rapinet Partner, London

There are significant barriers that compliance leaders in the UK are facing in terms of ESG risk management. Almost all UK leaders – 93% – believe that ESG risk management is impeded due to problems around embedding ESG in existing risk practices, and 89% assert that it is impeded due to a lack of ESG knowledge and skills.

Awareness and maturity of ESG programs in the UK is certainly significant. 52% of UK-based respondents felt that there was good awareness of ESG and its benefits and that there was a formal structure and processes in place within their organization - but that ESG is still largely seen as an isolated activity and separate from their AB&C program. All respondents predicted that the current level of investment in ESG (both program/policies and compliance) would increase within their organization within the next 12 months.

The UK market certainly appears to be committed to embedding ESG principles into its compliance regimes and in turn into its operations. Whilst there is no single, all-encompassing piece of legislation dedicated to ESG in the UK, change is almost certainly coming. The Government is considering the option of bringing into law an offence of failure to prevent human rights abuses. There is certainly precedent for the principle that companies operating in the UK should take action, and responsibility, domestically to prevent criminal activity abroad. Organizations in the UK are already primed for the requirement of transparency in their supply chains, as certain commercial organizations must already publish an annual statement setting out the steps they take to prevent modern slavery in their business and their supply chains. This might well explain the greater level of ESG engagement which appears to be present in the UK.

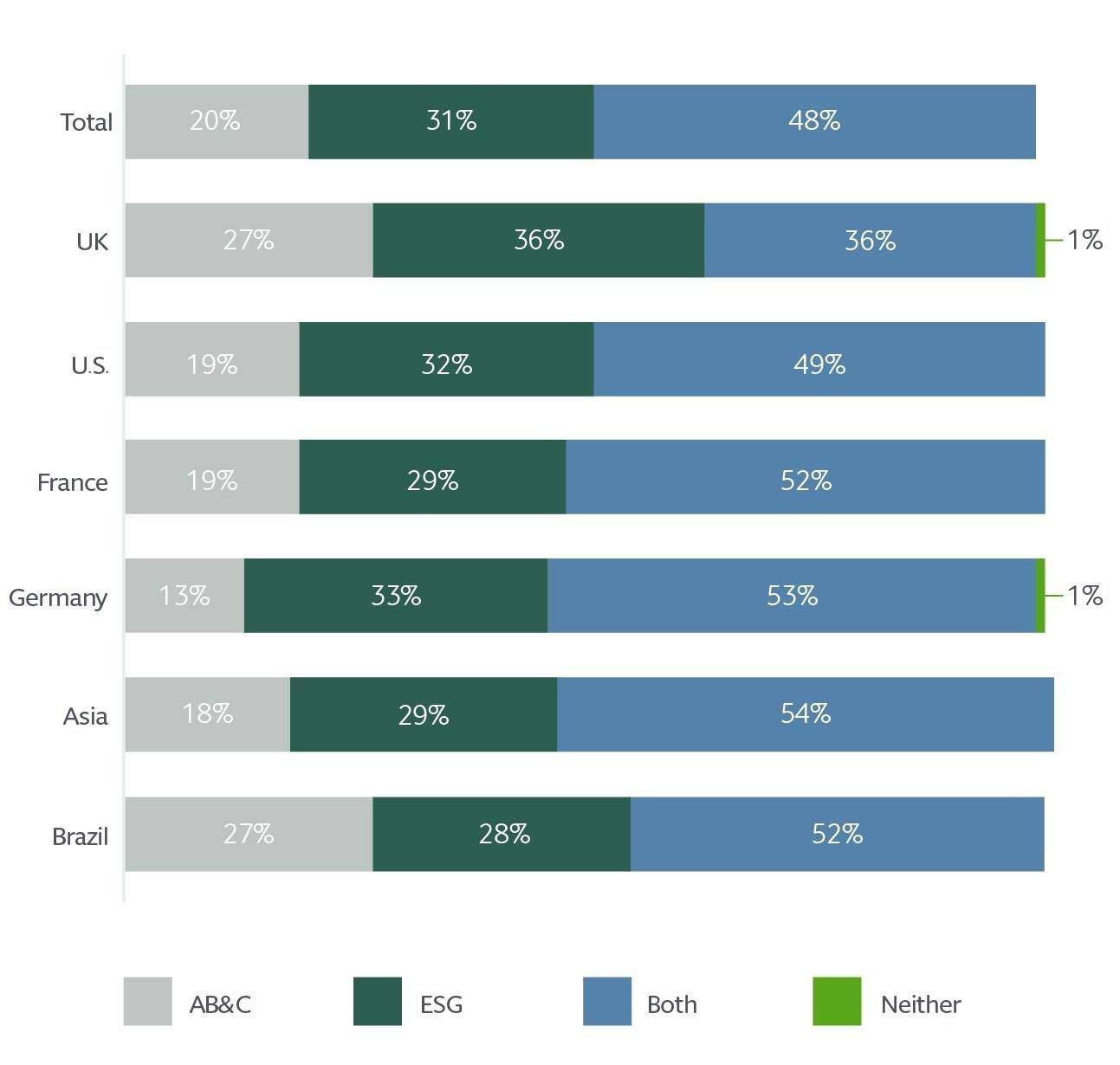

When there are competing priorities between ESG and AB&C, in your opinion what does your organization typically tend to prioritize?

France spotlight

By Arthur Dethomas Partner, Paris and Christelle Coslin Partner, Paris

Compliance leaders in France are the most likely (66%) to claim that their ESG program has increased their organization’s revenue in the last year, and just over half (52%) believe that, when there are competing priorities, their organization still prioritizes both ESG and AB&C – supporting the notion that integrated ESG and AB&C policies can have a positive financial impact.

It is also clear that ESG is influencing board behavior in France, as 72% of compliance leaders say that their organization’s M&A activity is increasingly being driven by ESG policies. This could be explained by the enactment of a decree and order in 2017 that implemented the European Directive on Non-Financial Reporting. This directive introduced provisions that require certain companies to include information on their performance or impact on the environment, human resources, social aspects, human rights and the prevention of bribery and extortion in their annual report.

Our findings suggest that French companies may be underestimating the risk presented by relationships deeper in the supply chain, however; only one in five business leaders in France believe that ESG risk management is impeded due to risk created by subsidiaries – compared to 43% in the U.S. and 40% in the UK and Brazil. ESG litigation is no longer a mere theoretical risk in France. Since the French Law on Duty of Vigilance entered into force in 2017, formal notice proceedings and compensation proceedings have been initiated in France in a growing number of cases affecting various industries.

Germany spotlight

By Christian Ritz Partner, Munich

The benefits of integrating ESG risk management with AB&C protocols appear to be emerging in Germany. Not only does Germany have the highest number of compliance leaders operating developed ESG policies, (50% ‘high-maturity’, vs. 7% ‘low-maturity’), but 53% of organizations in Germany claim that when there are competing priorities between ESG and AB&C, their organization typically prioritizes both (compared with 36% in the UK).

However, almost seven in 10 compliance leaders (69%) in Germany feel that limited resources within their teams are diluting the effectiveness of both AB&C and ESG compliance program and policies.

To what extent is ESG risk management impeded due to the below considerations?

Brazil spotlight

By Isabel Costa Carvalho Office Managing Partner, São Paulo

Brazil is the outlier from the other markets in the study, with both the highest number of organizations operating a low-maturity ESG program and the fewest with a high-maturity program. Our findings also indicate that compliance leaders in Brazil are not planning on increasing investment in their ESG programs significantly soon, with 61% intending to increase their level of investment in ESG by up to 5% in a year’s time, and the rest (39%), aiming for a 6-10% increase.

However, 87% of compliance leaders in Brazil confirm that assessing ESG risk is an active priority for their compliance team – the highest figure across all of the markets covered in this research – and only 47% agree that limited resources within compliance teams are diluting the effectiveness of both AB&C and ESG compliance programs and policies.

Brazil does not have a specific ESG Act, but it is important to note that Brazil has already enacted various pieces of legislation that address (and impose) ESG-related topics. These provide extensive sustainability, social responsibility, and corporate governance obligations. Our environmental legislation provides for corporate criminal liability, and imposes vast environmental obligations, such as the preservation of native vegetation and environmental impact mitigation obligations. We have labor legislation that is widely known as a stringent and pro-employee law, which provides the employees with an extensive set of rights that cannot be waived. Our public procurement legislation requires bidders to evidence their compliance with labor and environmental legislation, beyond simple social inclusion and diversity metrics. And the Brazilian Constitution forbids discrimination based on gender, age, religion, and disabilities, and is widely applied in employment relations.

Given their legal obligations, it’s highly likely that Brazilian companies are much more advanced in their compliance with ESG obligations than they claim. They may just view these topics as business as usual.

Asia spotlight

By Nick Williams Partner, Singapore and Calvin Ding Partner, Shanghai

Our study revealed Asia (54%) as the leading market in terms of prioritizing both ESG and AB&C when faced with competing priorities. This is supported by 76% of leaders also describing AB&C and ESG risk management as aligned programs – rather than competing priorities – in their organization. However, lack of engagement is seen as a major barrier to ESG risk management, with 63% of compliance leaders in Asia identifying it as a challenge, compared to just 45% in the U.S.

To some extent these findings are reflective of the fact that many Asia-based leaders are faced with the task of handling both ESG and AB&C portfolios, but trying to filter engagement across multiple different Asian jurisdictions. This brings into play factors such as different legal landscapes, language barriers in educating staff on compliance matters, and cultural issues, which is likely reflected in the perceived lack of engagement.