Understanding the barriers to better ESG risk management is essential for supporting compliance teams as they formulate and integrate ESG processes with existing frameworks.

As recognized in part one, ESG management is disadvantaged by its complexity and the under-developed state of existing regulation in comparison with more established protocols like AB&C. Compliance teams are further hampered by the difficulty in determining where the responsibility for ESG management sits within an organization, and also by a lack of established skills, knowledge, frameworks, and best practice from which to draw.

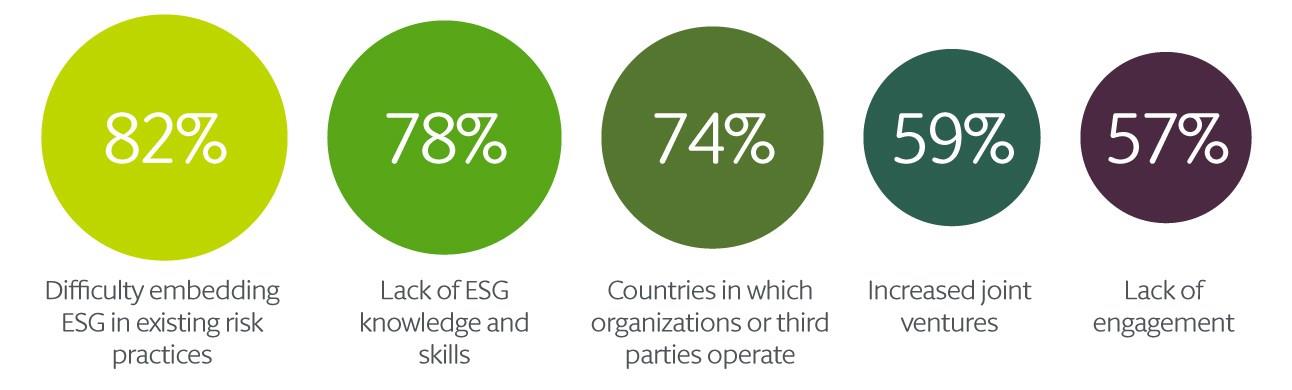

The research reveals that embedding ESG into current practices is the number one obstacle to organizations developing a mature ESG risk management program (cited as an important impediment by 82% of compliance leaders), followed by challenges ensuing from a lack of ESG knowledge and skills (78%) and the complexity of navigating different markets when it comes to understanding different requirements for third parties (74%).

Although this demonstrates just how much of a challenge lies ahead for compliance leaders, it is a challenge they are at least aware of.

Embedding ESG into existing processes can definitely be a challenge, even from a practical perspective. When you are a global company, you have a range of different systems and IT which makes it difficult.

Ansie Delport

Director - Ethics and Compliance, Rolls-Royce

Top 5 impediments to ESG risk management

Competing priorities

More than four in five (82%) compliance leaders claimed that difficulty embedding ESG in existing risk practices is impeding their organization’s ESG risk management.

Emerging from the pandemic, three in five (61%) compliance leaders also acknowledge that limited resources within their compliance teams are diluting the effectiveness of both AB&C and ESG compliance programs and policies. Compliance leaders may feel that they are faced with a challenge: focus on the known steady risks of AB&C – for which there are established procedures – or delve into the less-familiar waters of ESG risk and expand the number of third parties they need to assess?

When compliance capabilities are stretched, compliance leaders are understandably reluctant to draw their team’s attention away from AB&C programs – and more than a third of compliance leaders (37%) believe that, as more attention is focused on ESG, AB&C management is being overlooked and organizations are unwittingly acquiring additional risk. This is felt most strongly amongst compliance leaders in the automotive/transportation sector (45%), compared to those in lifestyle and consumer (24%) who felt least strongly.

Hogan Lovells solution

Many ESG and AB&C risks overlap or arise in similar contexts. Accordingly, AB&C and ESG compliance program should be consistent and complementary rather than separate or siloed. An integrated approach with collaboration between the relevant compliance experts is the best way to ensure both programs are effective.

The study shows that AB&C programs and ESG programs are less likely to be seen as competing priorities in organizations with more developed ESG programs: 54% of business leaders in companies with high-maturity ESG programs claim that they prioritize both AB&C and ESG, compared to 42% of those with low-maturity programs. This suggests that AB&C and ESG can be developed to run effectively in tandem.

Knowledge equals security

Bridging the ESG knowledge gap within organizations is key to successful and long-term integration. Not only is building awareness of ESG critical to making the right challenges and asking the right questions, but it is also important that employees are engaged with ESG programs to ensure they are embedded throughout an organization. At present, this gap is posing a problem; 78% of compliance leaders believe that ESG risk management is impeded due to lack of ESG knowledge and skills.

Hogan Lovells solution

AB&C compliance techniques can assist in mitigating ESG risk. For example, ESG training can help inform employees where risks lie and how to mitigate them so as to avoid liability. As with AB&C, it is also important to establish avenues for employees to flag concerns to the appropriate teams.

Streamlining international ESG operations

Navigating ESG requirements across international borders is complex; almost three-quarters (74%) of compliance leaders believe ESG risk management is impeded due to the markets in which they operate. This is perceived most strongly in manufacturing and industrials (79%) and least strongly in the life sciences sector (66%).

The different standards within and between jurisdictions can cause a lot of complexity. For example, in the U.S. there are both state and federal regulations to consider, and emerging markets often have significantly varying standards, with different markets focusing on different areas.

Hogan Lovells insight

Liam Naidoo, Partner, London

The problem intensifies in emerging markets where human rights risks supply chains are more prevalent. This is why having experts on the ground in key markets - who are familiar with local practices and customs - is crucial.

Hogan Lovells solution

In order to combat these complexities, businesses should consider setting their own minimum ethical and environmental standards, that they're able to apply across their global business while also ensuring that all legal requirements are met.

People often underestimate integrity risks of operating in certain markets. For example, if you are based in the UK, you might never be exposed to certain situations and customs, and therefore assume that integrity risks will be low in other markets. But countries have different risk profiles, and companies might be more exposed to integrity risks if they are not fully understood.

Bruno Silveira

Group Compliance and Privacy Director, Kingfisher plc

Hogan Lovells insight

Shelita Stewart, Partner, Washington, D.C.

AB&C and ESG regimes do, and will, share many common touch points. Corporates with an ingrained AB&C culture, reflected in policies and controls, will have in place a strong framework on which to build the governance limb of an ESG program. They will look to the common themes of transparency, fairness and accountability as the foundations from which to extend ESG programs.